Tracking your income sources might seem tedious, but it’s crucial for financial health and success. Whether you’re a freelancer juggling multiple clients, an employee with various income streams, or an investor, understanding where your money comes from empowers you to make informed decisions.

Understanding Your Income Streams

Before you start tracking, identify all your income sources. This includes your primary job, freelance work, investments (like dividends or rental income), side hustles, and any other form of revenue. Create a simple list to begin with.

Choosing the Right Tracking Method

Several methods exist for tracking income. You could use a simple spreadsheet, a budgeting app like Mint or Personal Capital, or even a dedicated accounting software. The best method depends on your needs and tech comfort level. For example, if you have many income sources, a spreadsheet might become unwieldy, making an app or software a better choice. Learn more about budgeting apps.

Categorizing Your Income

Categorizing your income provides valuable insights. Separate your income by source (e.g., salary, freelance project A, rental property). This granular approach helps you analyze which sources contribute most to your overall income and identify areas for growth or improvement.  You can then further categorize by type, such as earned income versus passive income. Read our guide on passive income streams.

You can then further categorize by type, such as earned income versus passive income. Read our guide on passive income streams.

Regularly Reviewing and Analyzing Your Data

Consistent tracking is key. Aim to update your records at least weekly or monthly. Regular reviews allow you to identify trends, potential issues, and opportunities. For example, if freelance income is consistently low, you may need to adjust your pricing or marketing strategy. Analyzing the data helps you make better financial decisions. Check out our tips for improving financial planning.

Tax Implications and Record Keeping

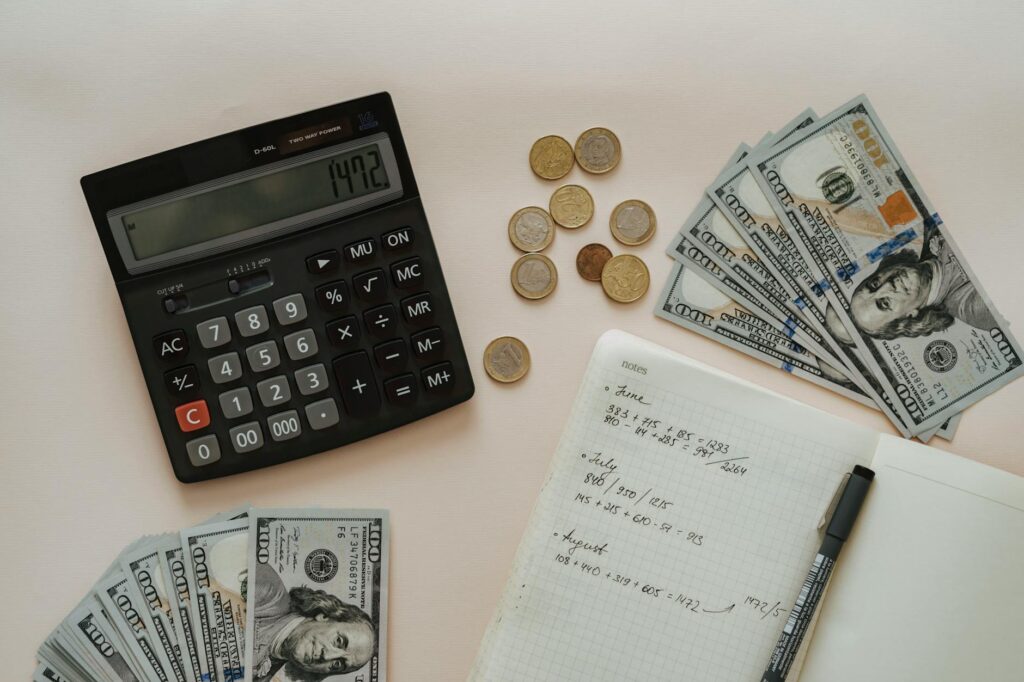

Accurate income tracking is essential for tax preparation. Keeping detailed records of all your income sources simplifies the tax filing process and helps avoid potential issues with the IRS. Consult with a tax professional or use tax software like TurboTax to ensure compliance. [IMAGE_3_HERE]

Conclusion

Effectively tracking your income sources provides a clear picture of your financial situation. This knowledge empowers you to make informed decisions regarding budgeting, saving, investing, and planning for the future. By combining consistent tracking with regular analysis, you can optimize your financial well-being.

Frequently Asked Questions

What if I forget to track some income? Try to estimate the missed income as accurately as possible and make a note to be more diligent in the future. Maintaining consistent tracking is more important than perfect accuracy.

How often should I review my income tracking data? Ideally, you should review your data monthly or quarterly to spot trends and address any issues.

What if I have a lot of different income streams? Using software designed for income tracking or a well-organized spreadsheet is highly recommended when you have many sources.

Are there any free tools to help me track my income? Yes, many free spreadsheet templates and budgeting apps are available online. However, features may be limited compared to paid options.

What should I do if I discover discrepancies in my income tracking? Investigate the cause of the discrepancies thoroughly. Correct any errors and implement measures to prevent future discrepancies.