Protecting your valuable jewelry is crucial, and a comprehensive insurance policy provides that vital safeguard. This guide explores everything you need to know about jewelry insurance, helping you make informed decisions to protect your cherished pieces.

Understanding Jewelry Insurance

Jewelry insurance isn’t just about replacing lost or stolen items; it covers damage from accidents, wear and tear, and even mysterious disappearances. Understanding the different types of coverage available is the first step in securing adequate protection. Consider whether you need coverage for specific risks or a broader, more comprehensive policy. It’s also important to understand the appraisal process and how it affects your claim.

Types of Jewelry Insurance Coverage

There are several types of coverage to consider, such as those offered by your homeowner’s or renter’s insurance, and standalone jewelry insurance policies. Homeowner’s or renter’s insurance policies often include limited coverage for jewelry, but this coverage is usually capped at a relatively low value. A dedicated jewelry insurance policy, on the other hand, offers significantly higher coverage limits and potentially more comprehensive protection. Learn more about the differences here.

How to Choose the Right Policy

Choosing the right jewelry insurance policy depends on several factors, including the value of your jewelry collection, your lifestyle, and your risk tolerance. You should carefully consider the deductible, coverage limits, and any exclusions. It’s always wise to compare quotes from different insurers to ensure you’re getting the best value for your money. Getting an accurate appraisal is a critical step in determining the appropriate coverage amount. Learn more about getting your jewelry appraised.

What to Include in Your Policy

When selecting a policy, make sure you’re adequately covered for all your jewelry items, including engagement rings, necklaces, earrings, and bracelets. Clearly document each piece with high-quality photographs and appraisals. Ensure that the policy covers loss, theft, damage, and other potential risks. Keep your insurer informed of any significant changes to your collection. You might also consider adding coverage for additional services such as repair or cleaning.

Filing a Claim

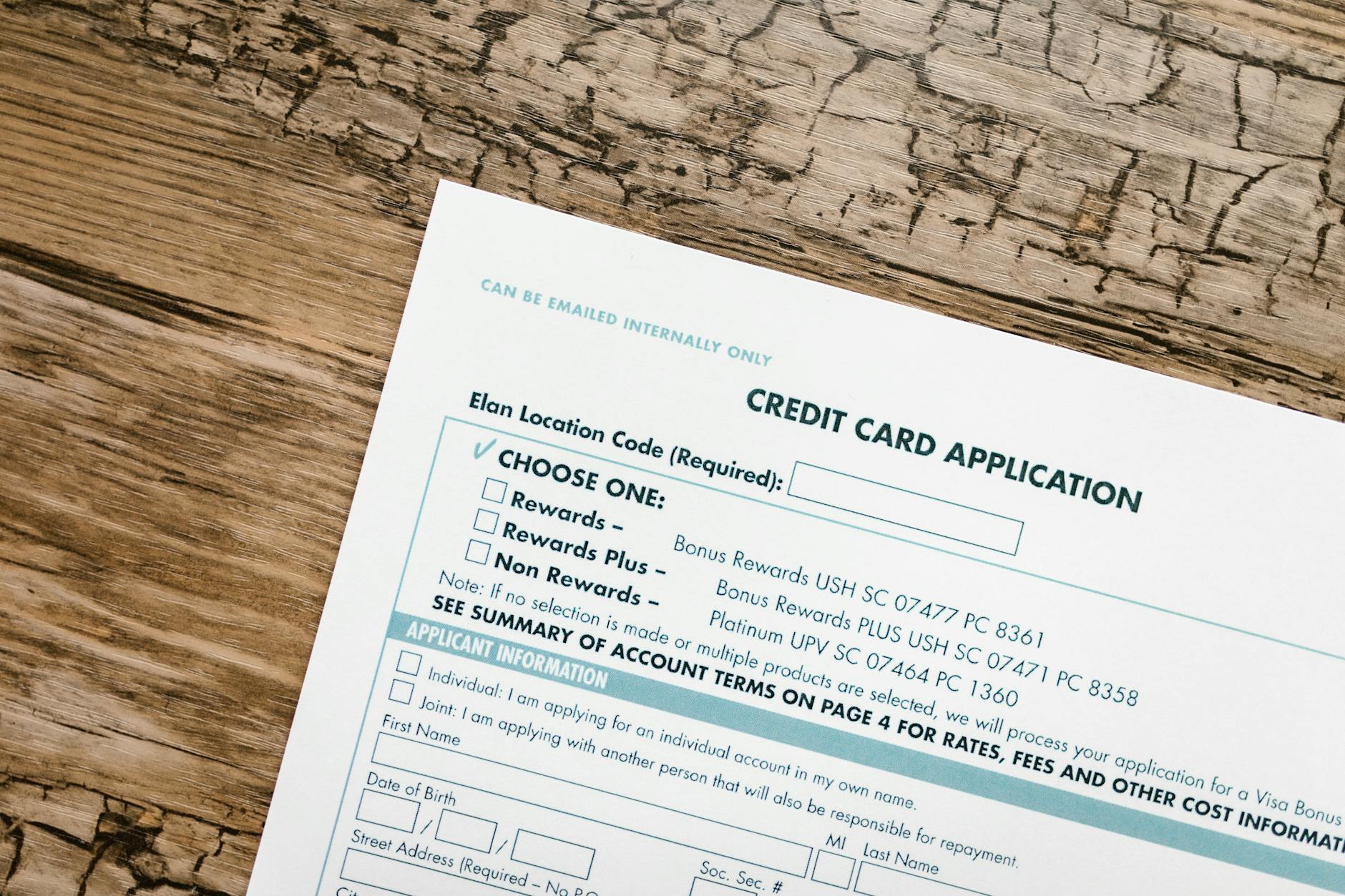

If the unfortunate happens and you need to file a claim, gather all necessary documentation, including the original receipt, appraisal, and any police reports in case of theft. Contact your insurer promptly and follow their claims procedure carefully. The process may vary depending on the insurer and the nature of your claim. Check out this helpful guide on filing claims. [IMAGE_3_HERE]

Conclusion

Protecting your precious jewelry requires careful planning and the right insurance policy. By understanding the different types of coverage, carefully selecting a policy, and documenting your collection, you can safeguard your investment and ensure peace of mind. Remember that proactive measures, such as using a safe or security system, can reduce your risk of loss or theft. A well-chosen insurance plan offers the best possible protection for your valuable pieces.

Frequently Asked Questions

What kind of jewelry is covered? Most policies cover a wide range of jewelry, including precious metals, gemstones, and watches. However, some items may have specific limitations or exclusions.

What if my jewelry is damaged? If your jewelry is damaged, you’ll need to file a claim with your insurer, providing documentation such as photos and repair estimates.

How often should I update my jewelry appraisal? It’s recommended to update your appraisal every few years, or whenever there’s a significant change in the value of your jewelry, due to factors like market fluctuations.

What is the deductible? The deductible is the amount you’ll pay out-of-pocket before your insurance coverage kicks in. This amount varies depending on the policy.

Can I insure inherited jewelry? Yes, you can usually insure inherited jewelry. You may need to provide documentation of its provenance and value.